Intraday Open High Open Low Trading Strategy

OPEN HIGH LOW STRATEGY

Intraday Open High Open Low Trading Strategy

The original name of the strategy is open deive. From a buy-sell perspective, we called it open high and open low.

Open high= sell

Open low= buy

So open rive and open high open low are both the same.

The logic behind the strategy

These are directional moves with strong hand participation and conviction.

Where does it occur? Location

It occurs most of the time after a sideways price action (tight price channel), or You can also spot it at the start of a trading session. From a strong supply or demand zone

If open-drive occurs after a sideways price action, it indicates that either strong buyers or sellers were accumulating their positions in the sideways price action, or afterward, they started aggressive buying or selling activity to move the price

If at the start of a trading session. An Open-Drive is generally caused by participants who have made their market decisions before the opening bell. The market opens and moves aggressively in one direction. Fueled by strong smart money activity, the price never returns to trade back through the opening range

The rule for selling open drive or open high strategy

Where is the action playing out? (location in the big picture). Reason to take the trade. Best work if a breakout from any sideways price action is or gap from a strong supply or demand zone

First, 5 min candle(opening candle) should be a big red candle Open = High, For easy reference 2-3 points buffer will be considered as equal not carrying much weight

The first candle opens to close around the lower of the candle (preferably)

Volume must be high

Minimum Risk: Reward(R: R)=1:2(next support area)

Breakout entry after opening range or first candle low(for open high set up)

The price must be below vwap for sell

Let’s do it as an example

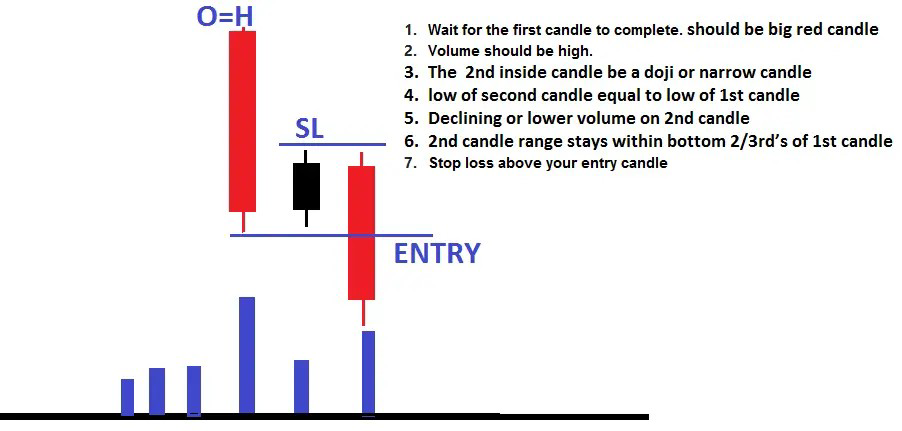

Open high strategy for entry

Wait for the first candle to complete. should be a big red candle

Volume should be high.

1 The 2nd inside candle be a Doji or narro candle

2 low of second candle equal to low of 1st candle

3 Declining or lower volume on 2nd candle

4 2nd candle range stays within the bottom 2/3rd of 1st candle

5 The price must be below vwap

Stop loss above your entry candle or day high as per your risk

Let’s do an example

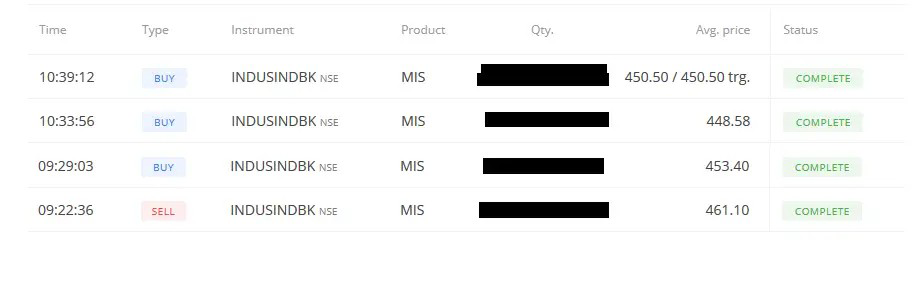

Today I took this

a daily time frame, the price increases with volume decreasing and closing near resistance. I clearly indicate me this move will not break the

Refrance

Today price gap is up to resistance. Then wait for 1st candle to complete

What first candle told me?

1 A big red candle

2 Open = High

3 First candle opens to close around the lower of

the candle

4 Volume very high

All these indicate bearishness. So sold in next candle. As shown in the below image

Comments

Post a Comment